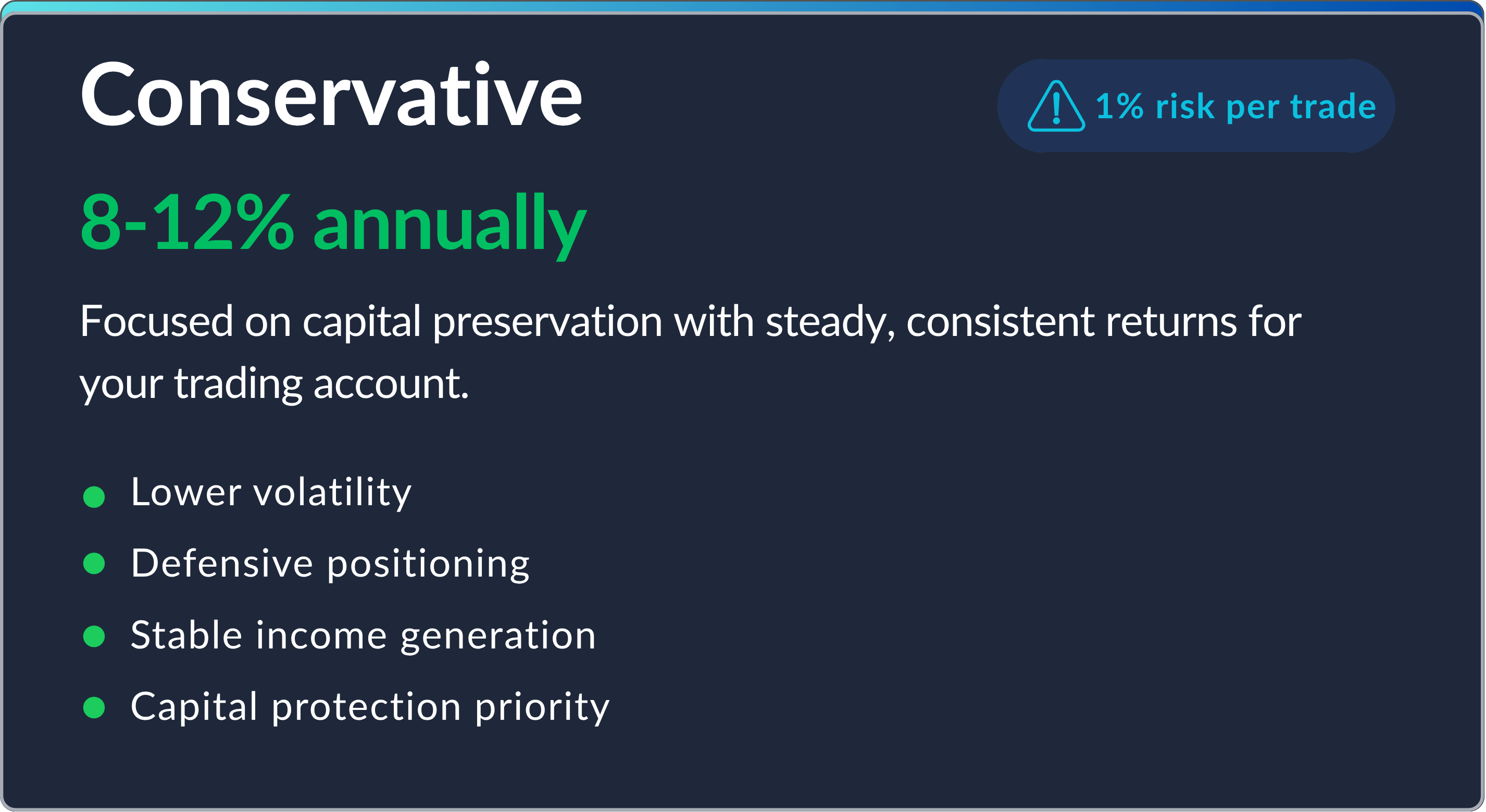

Conservative Trading Account Plan - Annual Returns

8-12% Annual Returns

$10000.00

Out of stock

Our Conservative Trading Account Plan is tailored for investors seeking steady, long-term growth with minimal risk exposure. This plan focuses on preserving capital while delivering consistent annual returns through low-volatility strategies, diversified positions, and rigorous risk management. Ideal for cautious investors, retirees, or those new to trading, the Conservative Plan aims to outperform traditional savings or fixed-income products without exposing your capital to aggressive market swings. Annual returns are targeted within a stable, sustainable range, providing peace of mind and financial predictability.

When you sign up for our Conservative Trading Account Plan, you’re trusting a team of experienced, certified trading professionals to grow your capital in a secure, low-risk environment. Here's how it works:

1. Account Setup & Integration

Once approved, your trading account is set up with one of our regulated brokerage partners. You maintain full ownership and transparency; your funds never leave your account.

2. Rule-Based Strategy Execution

Our team manages your account using time-tested, low-volatility strategies. These include:

High-probability setups across major indices or ETFs

Strict risk controls (e.g., 0.5–1% risk per trade)

Minimal exposure to aggressive market conditions

Zero emotional trading, only disciplined, rules-based execution

3. Capital Preservation First

This plan is designed for those who prioritize steady growth over fast gains. We focus on consistent performance, protecting your capital through:

Diversification

Controlled drawdowns

Position sizing that adapts to market conditions

4. Performance & Payouts

Your account is monitored daily, and we provide monthly performance dashboards. Returns are compounded annually, and you can withdraw profits or let them grow.

5. 100% Transparency

You get:

Monthly reports with trade logs and performance summaries

Direct communication with your account manager

Who It’s For:

Investors looking to grow their wealth slowly and securely

Retirees or professionals seeking an alternative to savings accounts, bonds, or CDs

Anyone who prefers professional, hands-off trading with lower risk exposure

Let us grow your capital conservatively but consistently, while you focus on life.